FREE CREDIT CONSULTATION Call Now 1-844-427-8482!

Credit Education

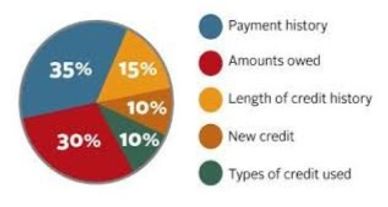

What makes up a FICO credit score?

- 35% PAYMENT HISTORY on any Open Accounts, on time payments & late payments are categorized here.

30% AMOUNTS OWED on Revolving Credit Card accounts aka available credit.

15% LENGTH OF CREDIT HISTORY is the time an account has been established.

10% NEW CREDIT Is the number of inquiries within a 12 month period.

10% TYPE OF CREDIT USED/ NUMBER OF OPEN ACCOUNTS are any open accounts; Revolving, installment loans, secure debt, auto loans, home loans etc.

Installment account vs. Revolving account

Installment credit gives borrowers a lump sum, and fixed, scheduled payments are made until the loan is paid in full.

Revolving credit allows a borrower to spend the money they have borrowed, repay it, and borrow again as needed. Credit cards and credit lines are examples of revolving.

Installment account

Mortgage loan

Home construction loan

Land loans

Revolving account

Credit Card

Charge Card

Secure Credit Cards

Length of Credit History Rating

To get the average age of your open accounts, you’ll add up the ages of each and divide that figure by the number of accounts you have open. For Example: This is how you would calculate 3 open accounts:

(15 years + 5 years + 4 years) = 24 years

24 years / 3 open accounts =

8 years average age

Equation to figure out Average Years of accounts:

Total Years / Number of open accounts = Average years of accounts

If a fourth account were newly open which would have an age of zero years, your average age of accounts would drop to six years;

24 years / 4 cards = 6 years average age

Total Accounts Open Rating

The Credit bureaus suggest five or more open accounts. This can be a mix of cards and loans. Having very few accounts can make it hard for scoring models to render a score for you. There is no universal number of open accounts & Your credit score won't tank once you hit a certain number of open accounts as long as they are maintained: on time payments, keep credit card balances low & no more than 6 inquiries in a 12 month period.

Sources:

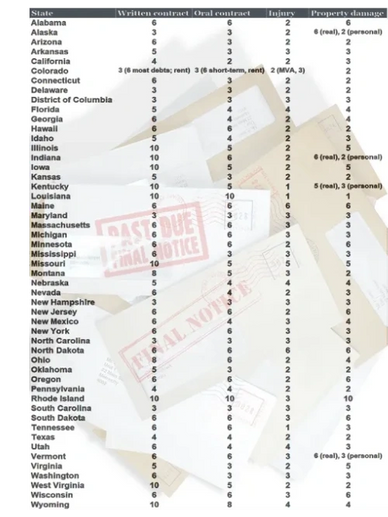

Credit Statute of Limitation on Old Debt

A statute of limitations is a law that sets the maximum time that parties have to initiate legal proceedings from the date of an alleged offense.

Source:

https://www.investopedia.com/terms/s/statute-of-limitations.asp

What is a Good credit Score?

" Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent."

Source:

https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score/

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.